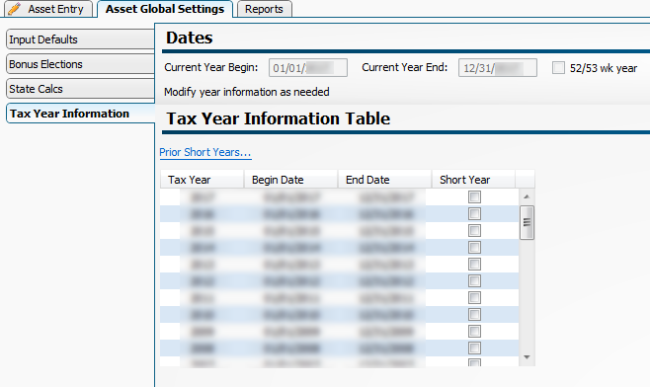

Tax Year Information

Tax Year Information can be found under the Asset Global Settings tab. Tax year and short year information is used to determine what year of the recovery period a particular asset is in.

The Tax Year Information Table on the Tax Year Information tab will be visible for any return type that supports a short year.

If you are creating a new business return, Fixed Assets will try to set up your short year based on the begin and end dates entered on a main form such as the 1120, 1120S, 1065, 990, or 1041.

Whether starting a new business return or rolling a prior year return, review the Tax Year Information Table to make sure it accurately represents short, fiscal, or calendar years since these determine depreciation calculations.

Tax Year Information Tab

Prior Year Short

To establish a short year for a new return:

- Click the Asset Global Settings tab.

- Click the Tax Year Information tab, and click Prior Short Years.

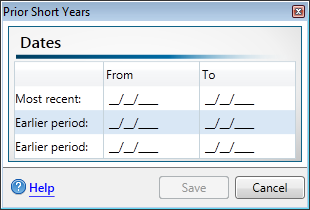

Prior Short Years dialog box

- Enter prior short year information.

Up to three prior short years may be entered.

- Click Save to complete the process.

See Also: